BAI Chong-En delivers his speech.

The School of Economics and Management at Tsinghua University (Tsinghua SEM), the National Institute for Fiscal Studies at Tsinghua University, and the Becker Friedman Institute for Economics at the University of Chicago collaborated to host the 2023 Asian Meeting of the Econometric Society in Beijing. The event took place from June 30 to July 2 and featured the participation of internationally renowned scholars, who delivered keynote speeches.

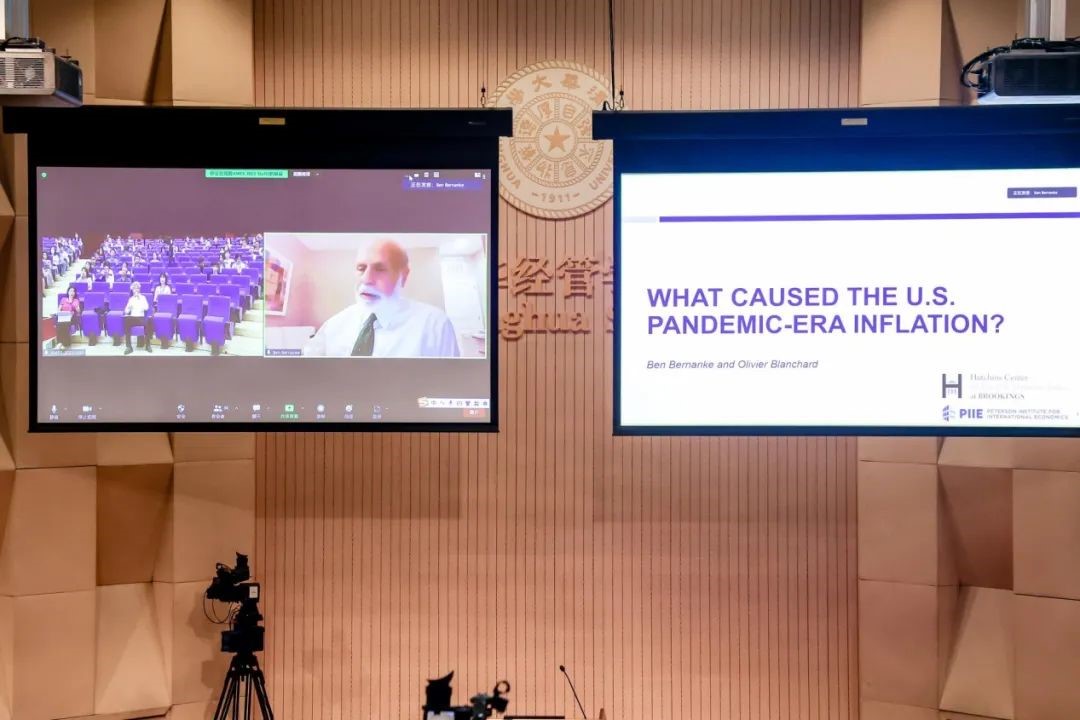

Ben Shalom Bernanke speaks at the event.

The meeting commenced at the International Lecture Hall, Weilun Building at Tsinghua SEM on the morning of June 30. Dean BAI Chong-En was among the speakers in attendance. During the Chow Lecture session, Ben Shalom Bernanke, recipient of the 2022 Nobel Prize in Economic Sciences and a fellow of the Brookings Institution, delivered a fascinating speech titled "What Caused the US Pandemic-Era Inflation?"

QIAN Yingyi speaks at the meeting.

As part of the program, a reception for the meeting took place at the sunken plaza in front of the Lihua Building on the evening of June 30. QIAN Yingyi, a professor in the Department of Economics and a Distinguished Professor of Arts, Humanities and Social Sciences at Tsinghua University, as well as the former fourth dean (2006-2018) of Tsinghua SEM, attended as a speaker. In his speech, he gave an overview of the meeting, provided details about the newly constructed building at the school, and discussed its intended purpose and functionality.

JIN Liqun delivers a speech.

On the evening of July 1, JIN Liqun, the President of the Asian Infrastructure Investment Bank (AIIB), gave a speech titled "The Need for Multilateralism in the Era of the Polycrisis." In his speech, he underscored the crucial role of multilateral cooperation in addressing global challenges, promoting development, and maintaining global order. He also presented his views on the reshaping and reform of multilateralism.

John A. List delivers a speech.

Professor John A. List from the University of Chicago delivered a speech titled "What We Can Learn from Field Experiment in Partnership with Firms? " on June 30. The session was moderated by Professor LU Fangwen from Peking University. Professor List highlighted the importance of partnering with enterprises to gain a deeper understanding of the world and make improvements. He also advised young scholars interested in conducting field experiments.

HE Zhiguo delivers a speech.

Professor HE Zhiguo from the University of Chicago delivered a speech titled "Share Pledging in China: Funding Listed Firms or Funding Entrepreneurship?" The session was moderated by Professor HE Ping, the Vice Dean of Tsinghua SEM. HE Zhiguo focused on equity pledges in China and analyzed the allocation of funds following the pledge of equity by shareholders in publicly listed companies. In China, equity pledges are prevalent and are commonly regarded as a means of financing for listed companies. However, HE Zhiguo's research revealed that a significant portion of the funds from equity pledges in Chinese publicly listed companies were actually used outside of those companies, with a considerable amount being allocated to entrepreneurial activities. This finding challenges conventional wisdom.

James Poterba delivers a speech.

Professor James Poterba from the Massachusetts Institute of Technology (MIT) delivered a speech titled "Retirement Security and Private Annuity Markets" on July 1. The session was led by Associate Professor WU Binzhen, deputy director of the Department of Economics at Tsinghua SEM. During his speech, Poterba said private pensions are an important direction for the future development of the old-age market, but they also require more policy support and academic research. The pension market has introduced various segmented products, such as individual pricing based on health conditions, lifestyle habits, and occupations. He questioned whether these product designs effectively address adverse selection issues, whether pensions should be mandatory in future retirement savings plans, and how pensions should be regulated. Additionally, he explored how public sector retirement security can complement private pensions. The topics offered opportunity for exploration and practical application.

Darrell Duffie delivers a speech.

Professor Darrell Duffie from Stanford University delivered a speech titled "How the US Treasury Market Can Become Dysfunctional?" The session was chaired by Associate Professor SHEN Tao of Tsinghua SEM. Duffie's research revealed the US treasury bond market experienced a liquidity shortage due to the impact of the COVID-19 pandemic, primarily due to market structure and the balance sheet capacity of dealers. Professor Duffie summarized the policy implications of his research, emphasizing the central bank should not only consider market liquidity when choosing the timing of market intervention but also focus on whether market makers' trading capabilities are overloaded. For instance, during periods of significant balance sheet pressure for market makers in March 2020, the central bank could intervene by purchasing government bonds to alleviate the liquidity shortage. The central bank can implement more market-oriented and transparent measures to support the market, while securities regulatory agencies can enhance the reckoning mechanism and provide a wider range of central settlement channels.

Hélène Rey delivers a speech.

Professor Hélène Rey from the London Business School delivered a speech titled "Answering the Queen: Machine Learning and Financial Crises" The session was chaired by Professor ZHU Yingzi of Tsinghua SEM. In her speech, Rey gave the example of a November 2008 visit to the London School of Economics and Political Science (LSE) by Queen Elizabeth II, who saw a chart highlighting the severity of the financial crisis and asked a simple question: "Why did no one see it coming?" Professor Luis Garicano responded, "At every stage, someone was relying on somebody else, and everyone thought they were doing the right thing.’ Months later, the British Academy sent a three-page reply, signed by LSE professor Tim Besley and political historian Peter Hennessy, to the Queen, explaining the reasons for the failure to foresee the timing, extent, and severity of the crisis and to head it off. One of the main reasons, among many causes, was a failure of the collective imagination of many bright people, both domestically and internationally, to understand the risks to the system as a whole. Additionally, macroprudential policies of various governments heavily relied on abundant information. In response, Rey shared her research, which provided a systematic answer aimed at predicting systemic financial crises three years in advance using machine learning. Rey acknowledged that although this machine learning prediction method is highly effective, it may not accurately make predictions in the event of a hacker attack.

CHEN Xiaohong delivers a speech.

Professor CHEN Xiaohong from Yale University delivered a speech titled "Stochastic Approximation of Generalized Method of Moments (GMM). " The session was chaired by Professor SU Liangjun of Tsinghua SEM. In her speech, Professor CHEN Xiaohong introduced the SA method for GMM, which is an online or real-time Stochastic GMM (SGMM) estimation approach. This method is particularly suitable for handling large online datasets and offers fast computation and efficient storage. Additionally, it serves as a real-time tool for strategy learning.

Stefanie Stantcheva (left) delivers a speech.

On July 2, Professor Stefanie Stantcheva from Harvard University delivered a speech titled " Using Social Economics Surveys for Economics Research ." The session was chaired by Professor YI Junjian from Peking University. Stantcheva spoke about the importance of drawing on data that represents people's emotions, attitudes, beliefs, and thoughts in social, economic, and political research conclusions through four case studies. Economists generally tend to use models and indirectly deduce these conclusions from directly observable statistical data. However, social surveys can reveal more information that is usually difficult to observe. Stantcheva said the appropriate use of social survey research methods can enable researchers to capture original identification variables and data that represent people's subjective emotional attitudes.

Professor XIONG Wei delivers his speech.

Professor XIONG Wei from Princeton University delivered a speech titled "State versus Market: China’s Hybrid Economy ." The session was chaired by Associate Professor DONG Feng. In his speech, XIONG Wei introduced three areas of his research related to China’s mixed economic system: the issue of information acquired for enterprises operating in this system, growth challenges, and the system’s impact on the real estate market. He emphasized that China's tremendous achievements after the reform and opening-up era are inseparable from the complementary relationship between the government and the market. When distortions in incentives arise, the interaction between the government and the market may deteriorate and lead to local debt difficulties.

ZHONG Xiaohan delivers his speech.

This annual meeting's academic report section comprised 140 parallel sessions, during which nearly 500 scholars shared their research findings on 140 different academic topics. The content encompassed both theoretical and empirical research, spanning a wide range of fields in economics. These included macroeconomics, international finance, international trade, public finance, financial markets, corporate finance, institutional economics, development economics, resource and environmental economics, experimental economics, labor economics, population economics, health economics, game theory, and high-dimensional econometrics.

Participants pose for a group photo.

On the afternoon of July 2, the closing ceremony of the annual meeting took place, where participants expressed their enthusiasm for deeper exchanges and discussions in the future.

Latest News

Latest News